The following information is best suited to sophisticated property investors. It has most relevance to customers with loans at one of the four major banks.

If you have an investment property loan which has not been reviewed for a few years you may be unnecessarily paying far too much on your loan. But to understand why, we need to take a quick look at recent history and a government agency called APRA.

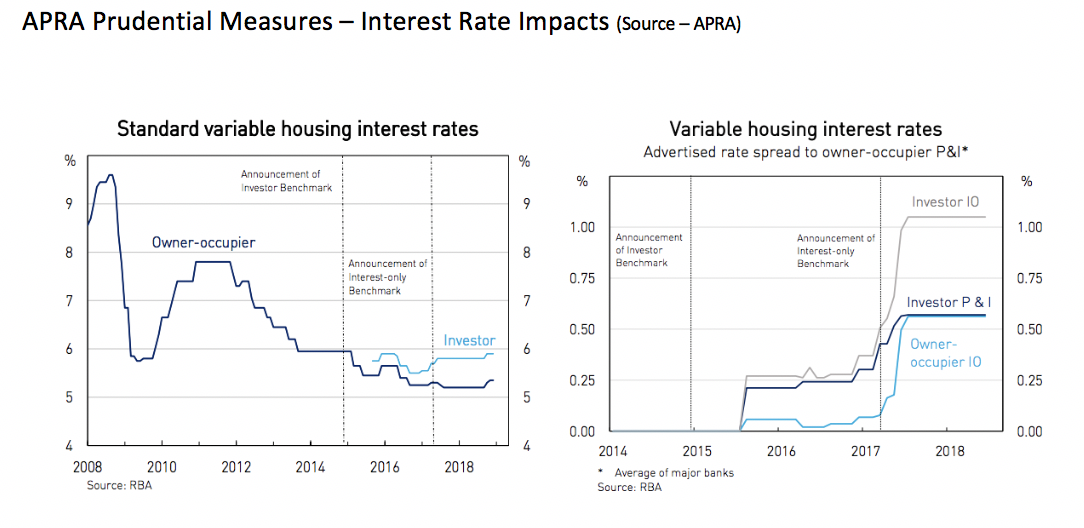

APRA is the Australian Prudential Regulation Authority. Their website lists their role as being “established for the purpose of prudential supervision of financial institutions and for promoting financial system stability in Australia”. They have introduced measures which impacted investment loan pricing and interest only loan pricing. A quick summary of the timeline is as follows;

December 2014 – APRA targets investment lending (10% growth per year). Lenders react by increasing investment loan base interest rates relative to owner occupied home loans.

March 2017 – APRA targets interest only lending (30% cap on total lending per institution). Lenders also react by increases to base interest rates for interest only loans.

April 2018 – APRA relaxes investment lending caps for smaller ADI’s (‘Authorised Deposit-Taking Institution’, ie smaller lenders) by removing the 10% cap on growth

January 2019 – APRA relaxes interest only lending restrictions.

July 2019 – APRA relaxes serviceability assessment guidance, allowing lenders to reduce servicing rates below the standard 7% floor rate.

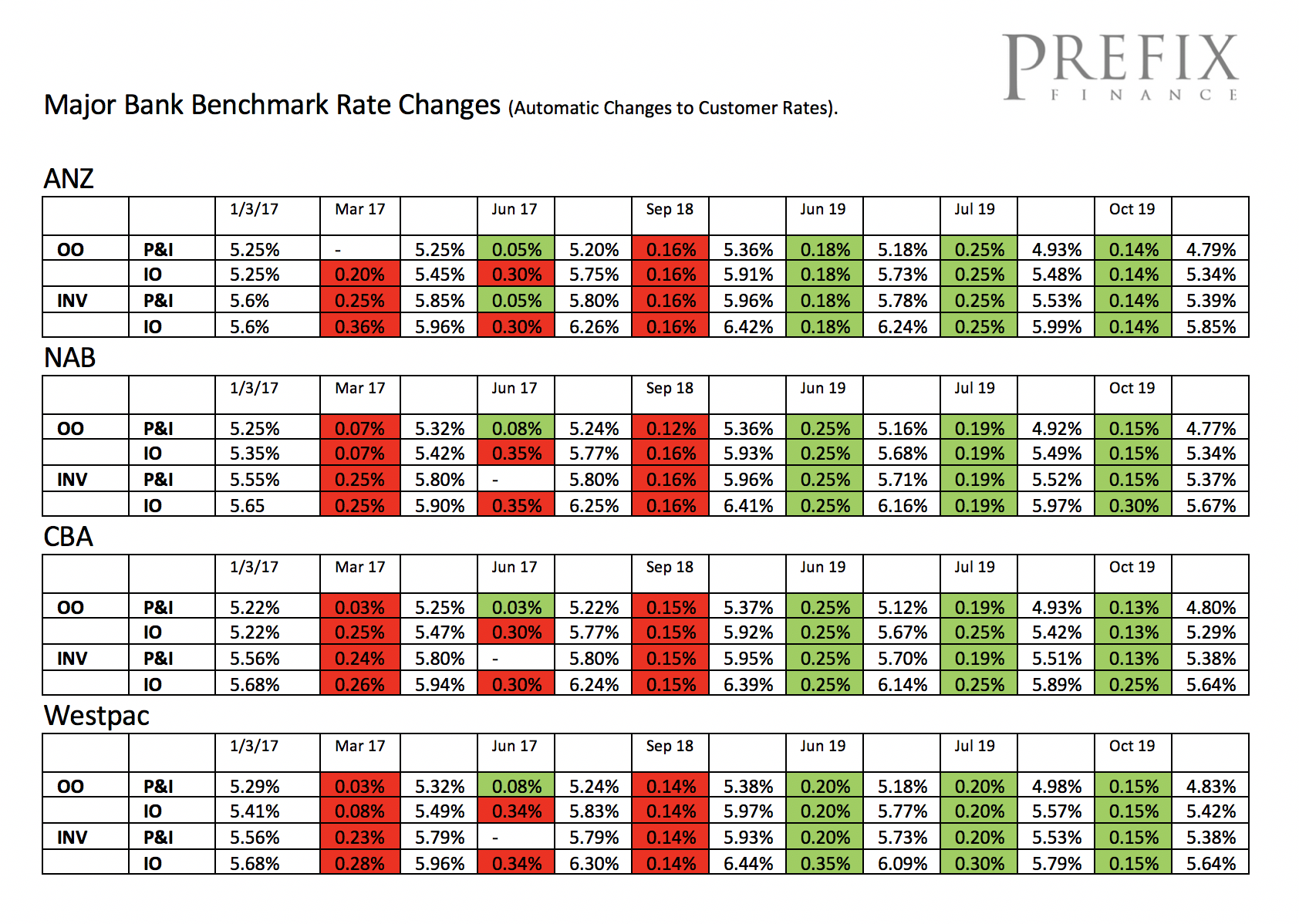

Since December 2014 there have been two APRA measures that increased base rates for typical Investment Loans (Investment purpose and also Interest Only) by up to 1.00%. But with APRA's removal of these measures the greatest reduction in lending to investors has only been several reductions totalling 0.25% (Westpac Investor Interest Only loans). These extra reductions have been passed on when the RBA reduced the cash interest rate.

At the major banks (ANZ, CBA, NAB, Westpac) these increases were applied by an increase to the base variable rate - which affected all existing and also future customers. However, the subsequent reductions to these loans has been possible through either reduction to carded fixed rate offers, or, in the case of variable interest rate loans, by an increase in the discretionary pricing discount offered. Both of which are offered to future customers but not automatically offered to existing customers.

The key point here is that to maximise the decrease to interest rates, the discount must be requested by the customer or their broker. The bank does not pass this discount on automatically.

Compared to existing customers, 'new-to-bank' customers will be receiving a better interest rate when they apply for their investment loan due to the larger discretionary discounts now being offered.

If you have not reviewed your investment property loan within the last two years then it is highly advisable that you review it now. You may unnecessarily be paying too much on your investment loans. A request for a discount to your loan takes us less than five minutes and requires NO income verification or application paperwork.

To check up on your current Home and Investment Lending situation we recommend contacting a Prefix Finance Mortgage Consultant. We keep on top of all changes to the lending environment and provide pricing review services free of charge to all our clients, existing and new.

October 2019

Additional resources: